Wake County Property Tax Rate 2024 Increase Synonyms – While it’s very likely Wake County homeowners’ homes will increase tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate . Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 tax bill would be if the county were to adopt the revenue-neutral tax .

Wake County Property Tax Rate 2024 Increase Synonyms

Source : robertreich.substack.com

Tech Tips Hardy Telecommunications

Source : hardynet.net

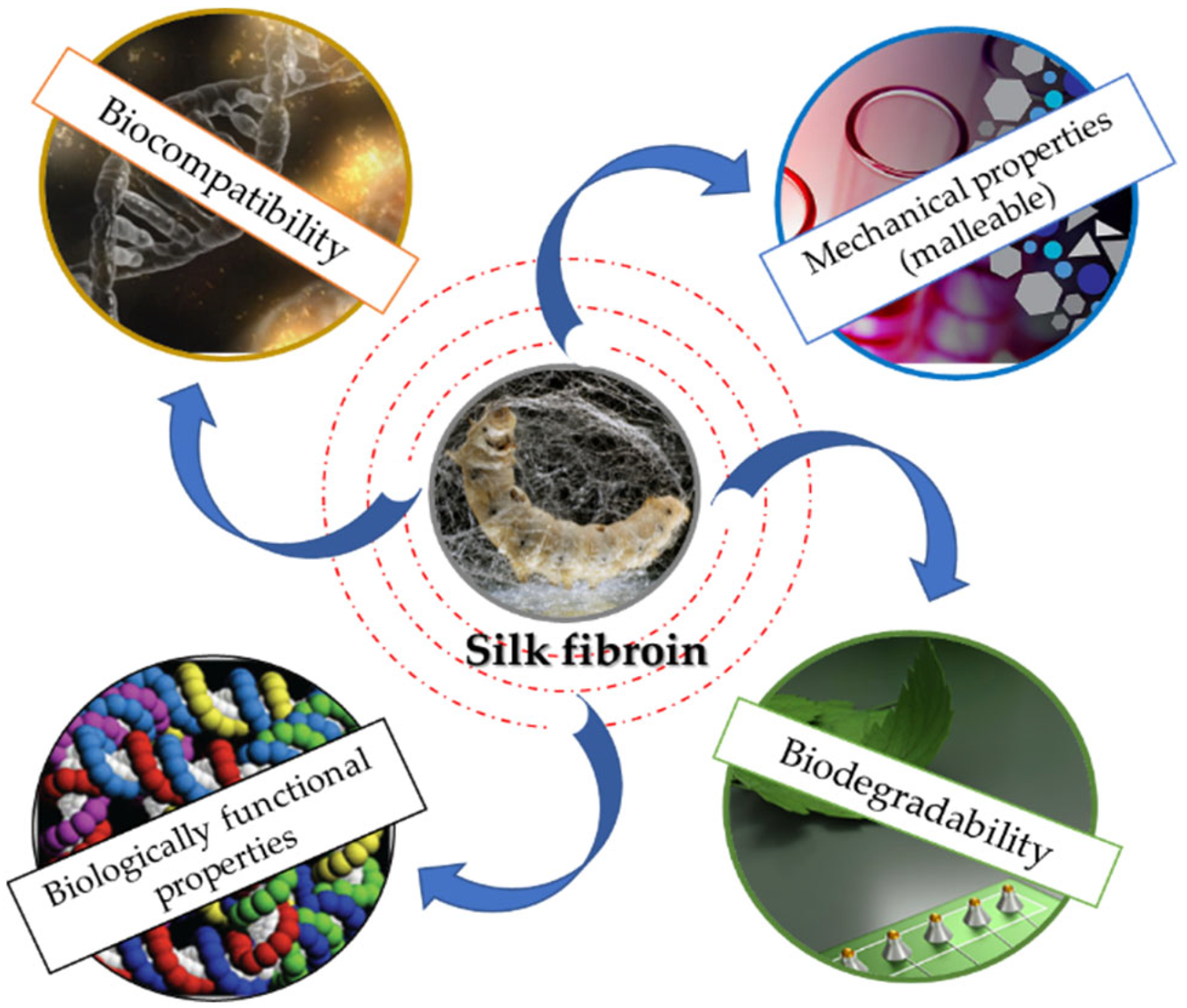

Insects | Announcements

Source : www.mdpi.com

June 1: Tracking Florida COVID 19 Cases, Hospitalizations, and

Source : tallahasseereports.com

Anonymous Responses: New Normal for Digital Life 2025 | Imagining

Source : www.elon.edu

Sponsor Detail Template – Chinese American Biopharmaceutical Society

Source : www.cabsweb.org

Commentary Archives Bleeding Heartland

Source : www.bleedingheartland.com

Defending Vehicular Crimes by TCDLA Issuu

Source : issuu.com

Housing Sector Stakeholders and Policy Advocates Testify on

Source : www.c-span.org

Defending Vehicular Crimes by TCDLA Issuu

Source : issuu.com

Wake County Property Tax Rate 2024 Increase Synonyms Are record levels of stress inside us — or outside us?: The Wake County Board of Commissioners got its first look at the 2024 tax bill would be if the county were to adopt the revenue-neutral tax rate. As a rule of thumb, if a property’s value . RALEIGH, N.C. (WTVD) — Homeowners in Wake County may soon have to pay more in property taxes. County commissioners said they expect property values to increase when 2024 revaluations are sent out. .