Child Tax Credit 2024 Eligibility Requirements Age – If you paid for childcare, you may also qualify for the child and dependent care credit. Depending on your circumstances, you can declare 20% to 35% of your childcare expenses. The maximum you can . VA Loan Requirements: What are the requirements to get a loan if you are a veteran? Personal Finance. Property Tax Rebate: Who is eligible to apply for a they can get by applying the additional .

Child Tax Credit 2024 Eligibility Requirements Age

Source : www.investopedia.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child Tax Credit 2024: How Much You Could Get and Who’s Eligible

Source : www.cnet.com

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Income Limits: What is the income limits for

Source : www.marca.com

Will You Get a State Child Tax Credit Payment in 2024? Find Out

Source : www.cnet.com

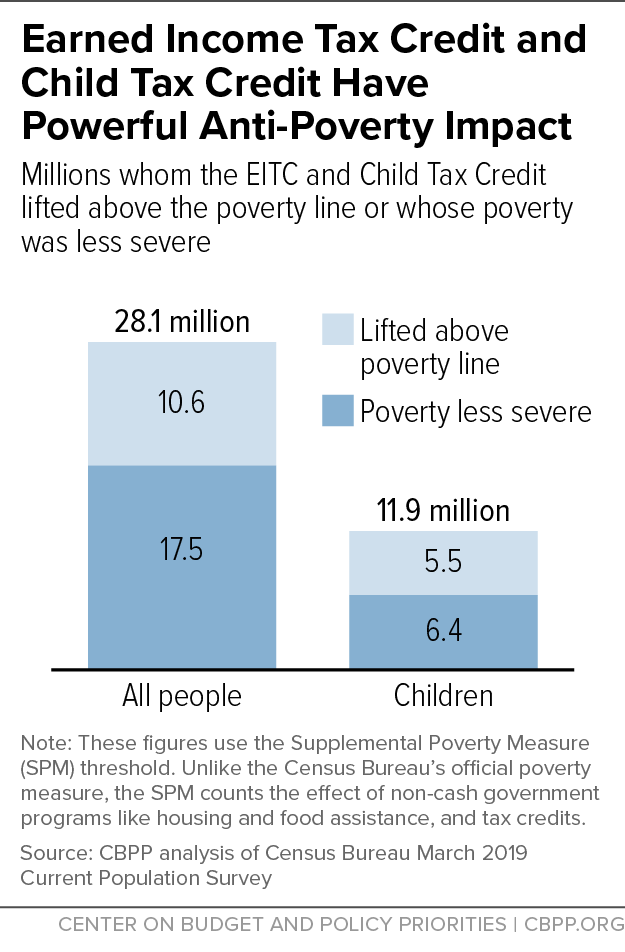

Policy Basics: The Earned Income Tax Credit | Center on Budget and

Source : www.cbpp.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Child Tax Credit 2024 Eligibility: Can you get the child tax

Source : www.marca.com

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

Child Tax Credit 2024 Eligibility Requirements Age Child Tax Credit Definition: How It Works and How to Claim It: For 2023 tax year, the maximum tax credit available per child is $2,000 for each child under 17 under Dec. 31, 2023, CNET reported. If you are eligible, it could reduce how much you owe in taxes but, . A guide to the Child Tax Credit in 2024. The child tax credit stands as a significant federal tax benefit designed to offer financial support to American taxpayers raising children. This credit allows .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)